)

We’re hearing about it all the time these days – the U.S. trade deficit widened in 2018 to a 10-year high, with the goods gap with China jumping to a record high despite tariffs on USD 250 billion worth of Chinese imports – all while the U.S. economy reached a level of growth it hadn’t seen since before the Great Recession.

Surprisingly, a lot of the commentary we are hearing about the trade deficit is negative. This highlights a major fallacy in understanding what our trade deficit implies about the state of the American economy.

How We Got Here

Let’s take a step back from the headlines and consider the state of our economy a decade ago when the trade deficit was at its 10-year low. GDP growth was negative, unemployment was high, and business investment was practically nonexistent. To sum it all up, things were not looking too pretty.

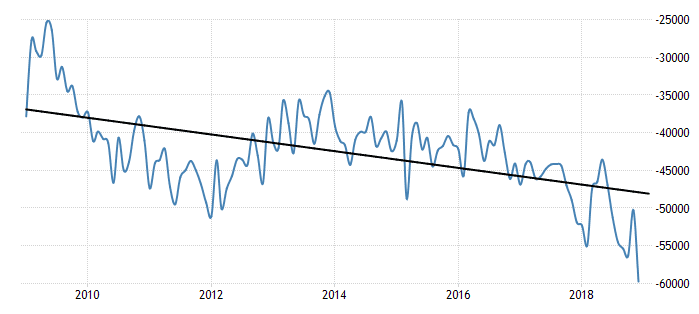

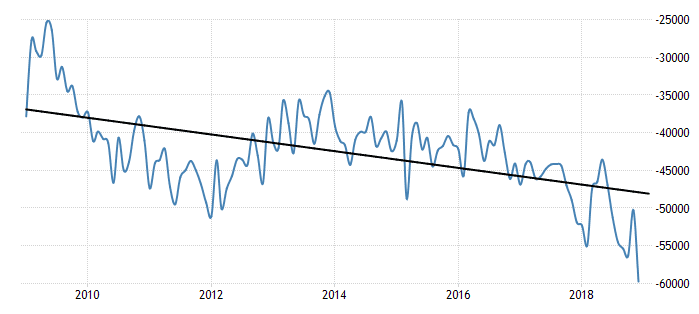

Over the next decade, the U.S. economy began its recovery while a majority of the world’s major economies remained stagnant or plunged into an even deeper recession. American business investment started to tick up, our unemployment rate steadily declined, and domestic consumption gradually started to pick up. All the while, our trade deficit was steadily increasing as shown by the trend chart from the U.S. Census Bureau containing the U.S. balance of trade from 2008 to the present.

So why did the trade deficit increase during this time? A combination of a stronger dollar coupled with American consumer consumption habits explains why.

While the rest of the world’s economies slugged through the early and middle parts of this decade, the American economic engine started to kick in gear. This situation spurred foreign investment into U.S. businesses. For a foreign investor to invest in an American company, they have to convert from their local currency in U.S. dollars. This, in turn, drives up the demand for the greenback, causing it to appreciate on the foreign exchange market (i.e. giving our dollar more purchasing power in international markets).

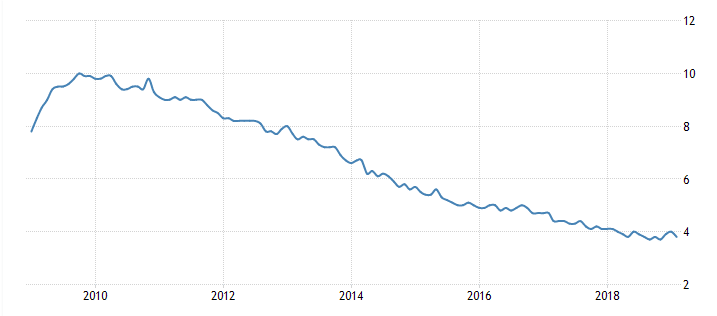

Simultaneously, as evidenced by the falling unemployment rate (see chart below from the U.S. Bureau of Labor Statistics) during that time, Americans steadily went back to work.

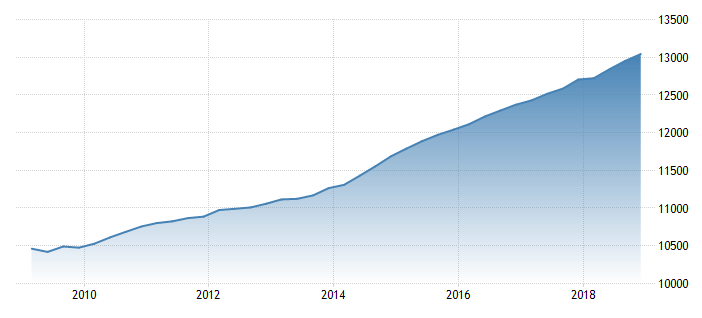

Once they were working again, American workers did what they are known for doing when you put a little money in their pocket – they spent it! The chart below shows U.S. consumer spending data from the U.S. Bureau of Economic Analysis over the last decade. Notice how the rate of growth in consumer spending starts to accelerate on a year-over-year basis starting in 2014, with the biggest gain coming in 2018, the first year of the new tax cuts.

As in the case of previous expansions fueled by consumer spending, Americans have desired more and more imports. Normally, this would put downward pressure of the dollar as U.S. businesses import those goods, exchanging dollars for whatever local currency they need to purchase those goods. That pressure; however, has not been greater than those previously mentioned forces driving the dollar’s value upward.

As a result, businesses have been able to maintain, and in many cases increase, already healthy margins on imports without having to raise consumer prices. Consumers have responded to his by continuing to increase their rate of consumption.

Combining all of this information together, it becomes apparent that the widening trade deficit is nothing more than a by-product of a healthy domestic U.S. economy coupled with weak global growth.

On the Horizon

You may be now asking yourself, “are these conditions are going to continue?” Much of the latest data and developments coming out points to much of the same for the rest of 2019.

The European Central Bank (ECB) just announced a new round of fiscal stimulus for the Eurozone to combat the weaker than expected growth from much of Europe. American businesses can expect a weaker Euro relative to the dollar, making much desired European luxury goods more affordable for American consumers.

In an interview last Sunday on ’60 Minutes,’ Federal Reserve Chairman Jerome Powell downplayed the risk of a recession. “We’ve seen a bit of slowing, but still to healthy levels, in the U.S. economy this year,” Powell told the CBS News program. Markets took his comments as an indicator that the Federal Reserve is pausing interest rate hikes, while opening the door to the possibility of slashing interest rates should the economy show any cracks hinting at a recession later in the year.

What is clear is that Chairman Powell is basing the Fed’s future interest rate decisions on the economic data that comes out. Given the final reports now out on economic output 2018, it’s hard for the Chairman not to feel positive about what he is seeing.

U.S. GDP growth in 2018 was 3.4%. Worker productivity in terms output per hour, the heart of growth in a market economy, grew at 1.8% last year after flirting with 0% for years. Subtracting the 1.8% productivity growth from the 3.4% growth in GDP leaves you with inflation of 1.6%. The Fed’s target goal for inflation is 2%.

Translation: American workers are producing more in less time, which in turn means businesses are becoming more profitable producing the same goods now than they were one year ago. Also, the risk of the economy overheating, which would cause the Fed to increase interest rate again, is minimal.

Therefore, in order to continue to thrive in the short-term while protecting oneself long-term against swings in the market, business owners need to be thinking about ways to make their employees more productive today through investments that do not limit the business down the road.

Gregg Mora

Chief Financial Officer

Dynamic Capital

Comments or questions? Email: gregg@dynamiccap.com